Wedding is one of the most important and special days that a person experience and everyone wants to make their special and remembering but with the continuous inflation, it has now become very tough to organize a wedding within a very restricted budget and for having a special wedding day, it’s now very important to finance it just like you do for vehicles and homes to avoid any kind of financial stress. So, now the question rises, How can I finance my wedding? or How can I get a wedding loan?, well it may sound silly, but there are many ways to borrow money or get loan for a wedding and that too online.

Here are the steps to get a Wedding Loan

Get a personal loan

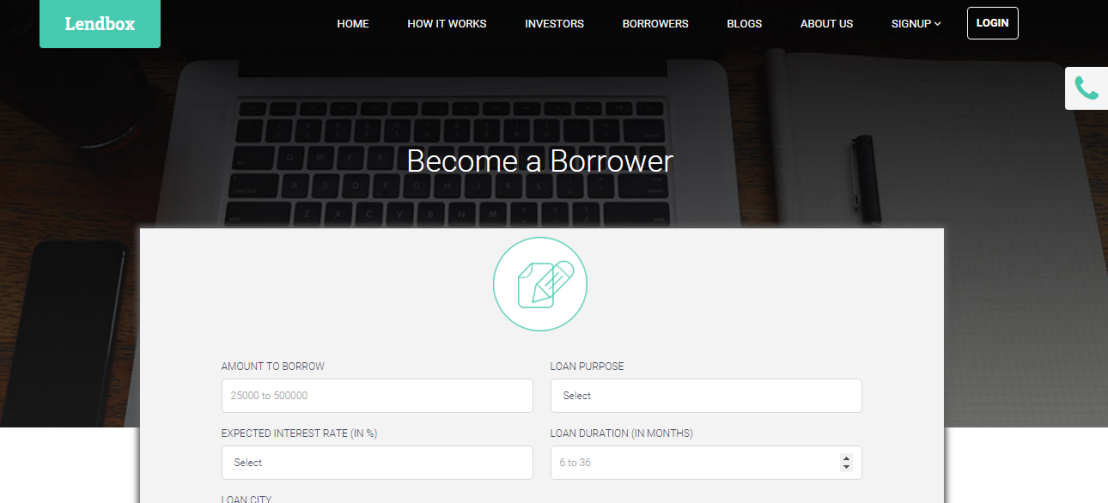

Even though, a personal loan have limits but if it covers your wedding budget then why not. Getting a personal loan on internet is not really tough but it still need to be done very carefully to avoid unnecessary expenses, you can use peer to peer lending with online lending platforms such as Lendbox and Prosper or if it’s too complex for you can go for regular banks if you can wait longer and doesn’t want to get into complicated things.

Below are steps for both cases

Wedding Loan Via Peer To Peer Lending Platform

- Register on a peer to peer lending website

- Fill in the data and upload the required documents

- Wait for verification and activation

- Request proposals to investors with your amount and reasonable interest rate

- If your credit score is good then you’ll get funded within 2 days otherwise wait

- Repay your amount in installments

In a p2p lending platform, you don’t have to wait longer and if you request proposals in small amounts and it increases the rate of approval and speed of funding but if you have a bad credit score then it will be hard to get the loan amount in time.

Wedding Loan Via Banks Or Other agencies

- Apply for a loan online

- Wait for revert

- Verification process will take place a few days after if your application granted

- After 2 to 3 verification processes, you will get loan

- Repay with easy monthly installments

When applying for a loan in Banks, you need to know that they have high rejection rate and if you have bad credit score then getting loan from banks is almost impossible since and keep in mind that processing fees in Banks can be a little high compared to other institutions and p2p lending platforms.

Should you really go for a Wedding loan

Before going for a loan for covering your marriage cost, you need to understand, on what terms you should go for a wedding loan and do you actually need it because in India “chacha mama milke hi kra dete h shadi” but on a serious note, if you have plans and support to cover up your event cost and you are using your credit card with maintained balance then there is no need to get loan from a bank or a lending platform.

You can arrange money offline if you have contacts as Wedding is something that you can easily borrow money for but in the end it all depends on you, whether to take a loan for your wedding or not. Take the decision that will help you improve your credit score.

Hope this post helped you understand how and where you can get loan for your marriage.